That of the pensions it is an extremely debated topic, at a global level. Many pension systems, in fact, could be jeopardized in the long term by the fact that the relationship between workers and pensioners is significantly changing. A theme that is particularly felt in our country, as they make clear the burning controversy that marked the launching of the Fornero law and the subsequent approval of 100 quota. To raise the alarm on our pension system and on its sustainability has recently been theOECD, with a report published and presented in Tokyo, entitled "Working better with age", whose theme is aging and employment policies. Indeed, the study states that by the 2050 in Italy the number of pensioners will be even higher than that of workers.

Blockchain and pensions: a winning combination?

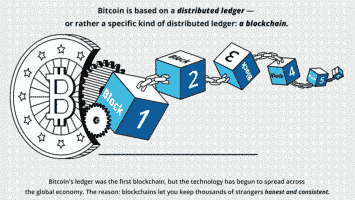

Secondo Paolo Gianturco, senior partner of Deloitte and FinTech manager of the company, interesting answers could come from the blockchain that can meet the needs of Italian citizens in a future that otherwise could give them many concerns. According to him, taxpayers and social security funds will be able to exchange data securely and in real time by leveraging a decentralized register. A modus operandi which could make it possible to make changes faster and at significantly lower costs than currently. It is therefore a series of innovations that will allow workers to adapt their future pension to their needs in a safe and immediate way.

Gianturco himself added that if it is difficult to specify for now the outlines that will characterize the changes in pension systems, it is not difficult to understand that blockchain technology will have a profound impact on the pension funds and pension funds segment. In this way, a virtuous circle can be set up, which can also lead to an increase in the number and quality of products available to families, allowing them to look more serenely at retirement age.

The AUCTUS initiative

In confirmation of what has been said so far, the news arrives from the United States according to which the American Startup AUCTUS would be willing to give a significant shock to the American pension market, often characterized by poor transparency, using blockchain technology and smart contracts.

Among the many unresolved issues in this regard are bad governance and poor performance practices, problems in collecting contributions, too many hidden costs, bad data management and recurring frauds. This last aspect has reached over the last two years clamorous dimensions, according to the Financial Times, with an 20% of pension schemes vitiated in this sense.

Precisely to overcome these problems, AUCTUS has decided to develop solutions that provide for an implementation of the blockchain Ethereum and the use of smart contracts. The system that will mix them will be used for the purpose of automatically track and collect pension contributions and pensions. Decentralized data management, considered not only safer but also more economical than centralized data servers, could give pensioners more appropriate treatments and greater safety.