on the crypto

Netflix is the American on-demand entertainment platform now known worldwide. Who doesn't love him?

Founded in 1997, it made its debut on the commercial market as a DVD rental business (films, documentaries, etc.) and video games. With the development of the internet and various technologies, he decided to direct his financial strategy towards the world of streaming services in 2007, extending its offer to Europe, South America, and only a few years later also to distant Asia.

Users, through a monthly subscription, can enjoy a completely personalized entertainment platform to follow their favorite TV series, films and documentaries, available in different languages.

Netflix shares today

The global entertainment giant was listed for the first time on the US Nasdaq stock exchange 18 years ago. The company can boast more than 160 million subscribers in over 190 different countries around the world, of which 2 billion in Italy alone.

Its share value therefore spiked sharply, growing by 400%. In 2019, it was called the most profitable stock in all of the United States. To date, the value of Netflix shares has quadrupled, even surpassing the performance of its main competitors such as Google and Amazon.

This American giant can therefore boast a market value of around 150 billion dollars. Do you also want to invest your capital in one of the most popular American giants in the world? All you have to do is read our article and we will explain how to navigate the difficult and complex world of the stock market.

How to buy Netflix shares

The shares of Netflix on the stock exchange have now captured the attention of many lenders who decide to participate with their capital and invest in one of the most popular entertainment giants in the world. To buy Netflix shares, you can choose to contact your trusted banking institution or decide to rely on the numerous online trading platforms. Let's see the differences and advantages together.

Many investors believe that relying on their banking institution to invest their capital is the best and most advantageous solution that allows them to obtain various financial guarantees on the stock market.

In reality, banks are now the past in the world of investments and, before proceeding, we must consider every aspect and evaluate its convenience. Many disadvantages can be hidden, such as significantly longer times, trading commissions and management costs higher than those of a broker, and poor and inefficient customer service (data not to be underestimated especially if you are not an expert in the sector).

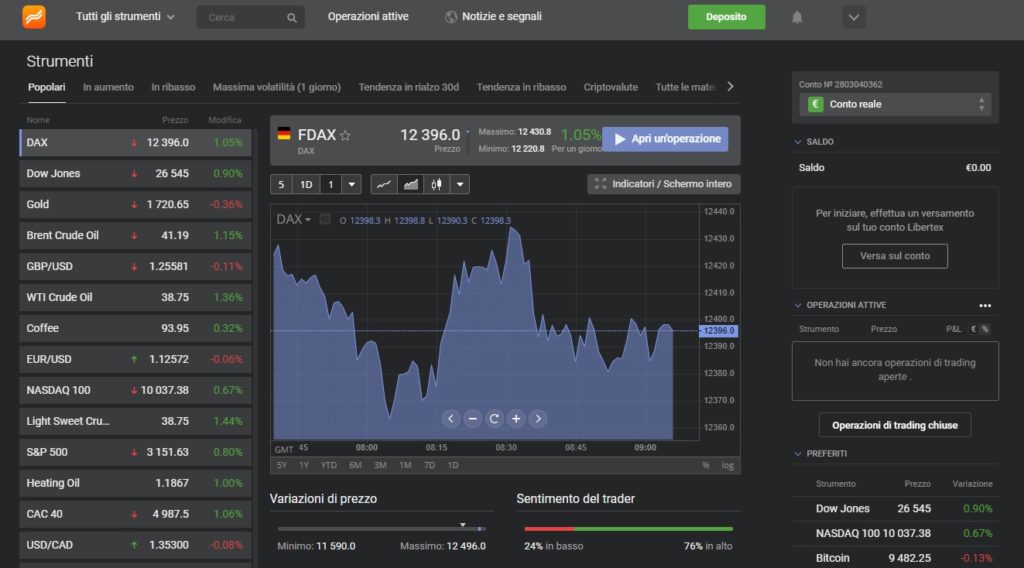

Anyone who wishes to invest in the stock market in a simple way can turn to the numerous online trading platforms that we find on the web. These are safe and reliable brokers, regulated by CySEC, which provide extremely low trading costs and allow you to obtain continuous returns. The best available in the industry?

How to create an account with Libertex

Using Libertex is quick and easy, like drinking a glass of water. This platform, secure and fully regulated to operate in Italy, can be used by beginners and professionals who wish to invest in shares without difficulty.

To start using Libertex, you need to follow the steps below. It takes 10 minutes and little information to get started:

- Access the Libertex website and complete the free registration form.

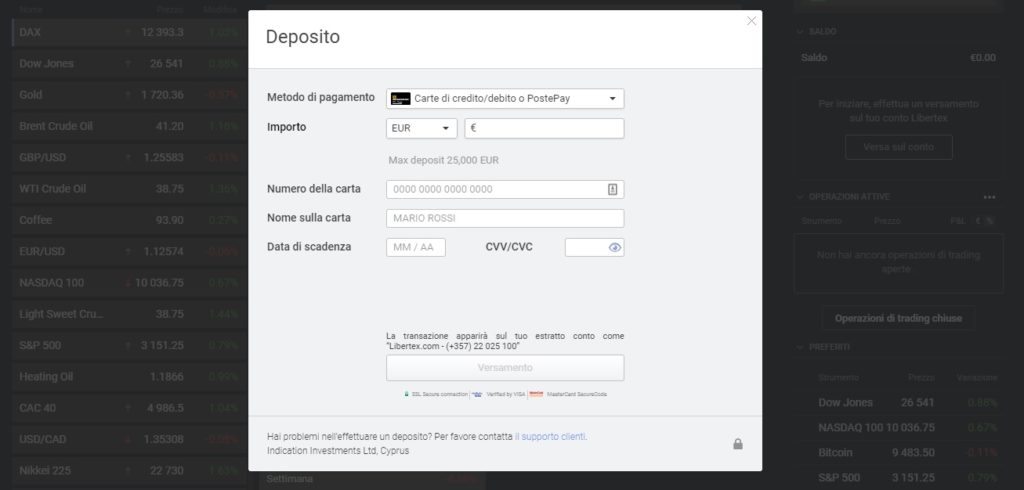

- Finance your account by choosing one of the payment methods accepted by Libertex, including credit cards and bank transfers.

- At this point you just have to verify your identity and start trading with its easy to use platform.

If you are always on the move, you can also follow the progress of your operations via tablet or smartphone. To do this you will not have to download any application, but simply type the Libertex website in the address bar of your mobile device.

Netflix shares forecast and how much a netflix share costs

Netflix is confirmed as one of the most profitable companies of the last 10 years. Only in 2008 his shares were worth very little while today, the cost of a single share is just under 400 euros.

If we consider its performance over the last 5 years, we can say that Netflix has enormous potential. Each year its value has soared and even today its shares, despite the ups and downs of the stock market, continue to be really attractive. The target to be achieved for Netflix shares for 2020 is set at 470 euros.

Analysts think that the global giant will be able to achieve this goal within the first half of the year and will be able to consolidate it in the following months. This is the umpteenth optimal result obtained by this company that has revolutionized the world of entertainment on demand.

Is buying Netflix shares worthwhile?

There are a lot of investors who have decided to buy Netflix shares in recent years. The company has achieved incredible results in just a few years. Just consider that in 2013 alone, Netflix saw its capital increase by as much as 300%.

Analyzing the history, growth and trend of the American giant in recent years, we can consider it an excellent investment in the short, medium and long term. There are several main reasons that make Netflix attractive and reliable:

- Users and approval rating. Investors often worry that the company they invest their funds in might lose ground. This is not the case with Netflix which has seen over the years a steady increase in users and the popularity ratings among spectators are really high.

- Competition. One of Netflix's main competitors is the historic Disney, but the two platforms have different characteristics. While Disney enjoys an excellent reputation among families, Netflix, with its varied and original content, opens up to a much wider audience. These refer to a completely different audience even if in some ways they share the same they share. In any case, the company has very few competitors on the market.

- The company can enjoy a solid and strong business structure that allows it to head in the right direction to keep growing steadily. Its business model perfectly satisfies both the demands of its users and the company's economic needs.

- The company is keen to further consolidate its position in the entertainment market by acquiring important partnerships such as that with Disney, Marvel and Pixar.

- Currently the American giant has about 150 million subscribers of which 60 million in the United States, and 90 million in other countries of the world. These are important numbers but still minimal compared to the market numbers that the company should reach in the coming years.

Conclusions

Netflix's stock has seen incredible growth and above all expectations in recent years. Making its way to Wall Street and the main world stock exchanges, including the Italian one, Netflix has increased the value of its shares, confirming itself as one of the best stocks to invest in.

With a constantly increasing positive trend and solid users, it confirms its leadership in the streaming entertainment sector. If you want to invest in the American giant, you can do it without too many worries but always with due caution.

With the support of the main free online trading platforms, you will be able to orient yourself in this difficult world in a simple way and you will be able to increase your earnings.