on the crypto

Today it is possible to buy Unicredit shares also online through easy-to-use financial instruments such as CFDs. Many still wonder if it is more profitable to trade Unicredit Spa shares in this way or if the old banking method is still valid. In this article, we will answer this question and also see how to trade Unicredit shares in real time with the best platform in the industry.

Compared to the old investment through a bank, CFDs offer numerous advantages, such as:

- Practicality of use - Bureaucracy is practically absent, moreover, you can invest and disinvest at any time (which is not possible once you have purchased the shares through the bank) and you avoid wasting time in consulting and authorizations.

- Fewer expenses – Regulated brokers do not apply commissions for trading CFDs on the value of Unicredit shares and therefore the profit margin is wider than for a bank investment.

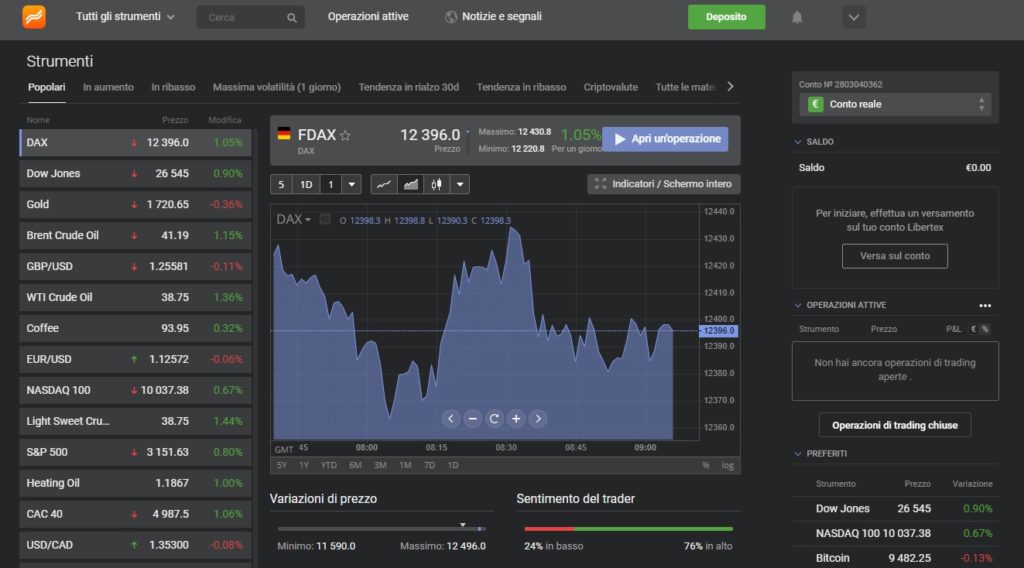

- It's more convenient - By investing through an online broker, you can follow the Unicredit share price in real time from home via your PC, or while out and about via your smartphone or tablet.

- Earnings in any direction - It does not matter if the Unicredit Borsa Italiana shares collapse, if you had foreseen it with the opening of your position in Short, you can still earn. By investing through a bank, however, you will only get a profit if the Unicredit share price increases.

Generally, to trade Unicredit shares we recommend using Libertex, a safe and reliable, but above all regulated broker, which allows you to operate via simple to use software, which offers flexible and modern financial tools.

If you are a beginner, Libertex is the platform best suited to your needs, as it also allows you to communicate with other traders through its social functions, such as copytrading. This feature allows you to automatically copy the actions of the best traders.

How to create an account with Libertex

Libertex is another platform that users can use for online trading. This is also a regulated broker used by millions of users around the world. Its main feature is the ease of use of the platform.

You can start using the free Libertex platform right away by following these 3 steps:

- Log in to the website and fill out the free registration form. The platform costs nothing, as the earnings are applied directly to the spreads.

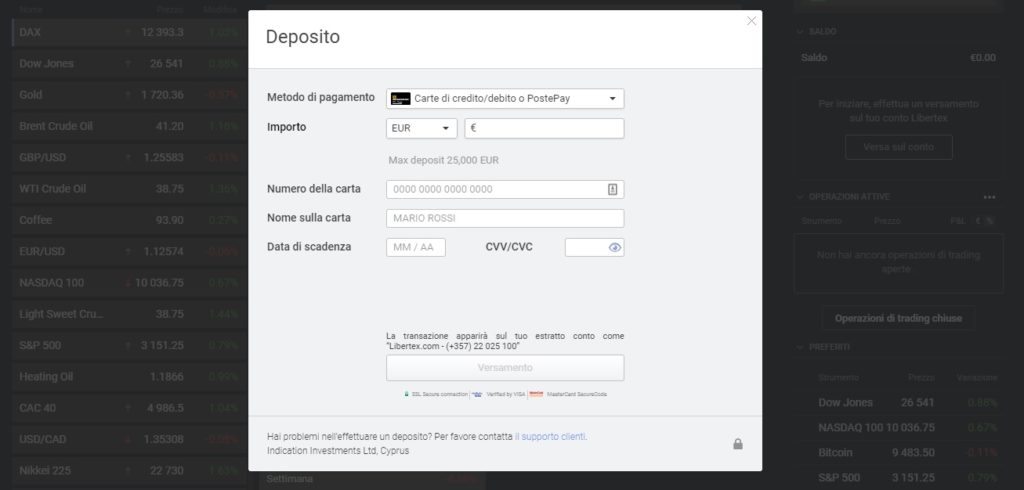

- Use credit cards or other banking methods to fund your trading account. Deposit that you will need to open trade positions.

- Now you just have to start trading live. Also remember to verify your identity within 30 days to be able to withdraw later.

You can check the progress of your operations also via iOS and Android device. To do this you will not have to download any applications, because the Libertex website is perfectly optimized for portable devices.

How much does it cost to trade CFDs?

If you use safe and reliable brokers like Libertex, trading Unicredit shares with CFDs will not cost you anything. Usually, these brokers earn by applying a spread to CFDs, which varies depending on the asset to be traded, but also depending on the operator.

The spread can be fixed and variable and the broker applies it directly to the opening of the exchange, so it is already counted at the end of the negotiation in terms of gain or loss. For this reason, the newly opened trade starts in red. So, to get a profit on Unicredit shares, it is first necessary to cover the spread, which in any case compared to bank commissions is much lower.

Unicredit share price forecast

To make effective forecasts on Unicredit shares, it is necessary to take into account at least a couple of factors that can influence the banking sector in Italy and therefore directly also this bank.

The first is the macroeconomic one and is particularly linked to the state of health of the Italian economy. The second concerns the regulatory sector that regulates banks and therefore also Unicredit.

Apart from the national economy, in the case of Unicredit, the bank's investments and exposures must also be taken into consideration. However, these look more to the international economy.

Those who want to make a long-term investment on the Unicredit stock quote today, must therefore consider several factors, which can not only understand the national scenario, but also the international one.

To be even more precise, the quarterly reports on Unicredit shares can be considered and studied, but also the annual and semi-annual reports, the reports of the Unicredit shareholders and the rating agencies that evaluate the banks.

On the other hand, there are several factors to consider if you want to earn CFDs in the short or even very short term (intraday). These factors can be announced and unannounced data releases, as unpredictable events that can affect Unicredit shares.

Why buy Unicredit shares

One of the main reasons why an investor should decide to invest concretely in the Unicredit stock lies in the strong solidity of this banking group, which is one of the first in Italy and in Europe. However, it should be borne in mind that this very popularity makes the title rather volatile and unpredictable.

If you want to invest in Unicredit shares in the short term, then all Unicredit forum shares will suggest you to do it with simple financial instruments to use such as CFDs. On the contrary, those who are more inclined to do things the “old way” can still turn to banking institutions.

In this last scenario, however, some fundamental considerations must be made:

- packages sold by banks do not include interest before 12 months

- the commissions are higher and therefore the possible earnings are lower

- you have no chance to influence the performance of your money

- investing in a bank does not mean that you have a better chance of earning

- by purchasing shares directly, in the event of withdrawal of Unicredit shares, the entire capital may be lost

Earnings in the short and very short term

Those who want to obtain rapid results, using low capital and operating in complete autonomy, must inevitably turn to CFD trading. CFDs can be easily traded online through regulated brokers such as Libertex. These platforms allow you to bet on the rise or fall of the stock, carrying out analyzes using the Unicredit shares graph in real time.

This means that when you trade CFDs, you do not actually buy Unicredit shares, but only speculate on the trend of its price on the Stock Exchange. However, this allows you to earn both on the upside and downside.

Accessing this type of platform is extremely simple, but the thing that matters most is choosing a safe and regulated broker. And it is precisely for this reason that we have decided to recommend an operator like Libertex, which is used by around 10 million people around the world.

The Libertex platform has proven itself over the years to be perfect for novice traders, as it features its most famous feature, social trading. This allows you to talk directly to other traders and ask for advice directly from people with more experience. Furthermore, with copytrading it will be possible to directly copy the actions of the best traders, who you can choose based on the performance rankings offered by Libertex.

The best advice we can give you to Unicredit shares comments is to register immediately on the platform to start your growth path. In the section dedicated to user training, you will also find numerous free courses to read to take the first steps in a better way in this sector.