on the crypto

There has never been a more profitable, nor a riskier time to be exposed to the financial markets. After the initial panic reaction to the outbreak of the pandemic that triggered the Black Thursday selloff, the stock market recovered to set new all-time highs, Bitcoin broke above $ 10.000 and gold set a new record for the first time in a decade.

Analysts call the current context "mania" and say that stocks are in a bubble ready to burst in an instant. Crypto is just recovering from bear market lows and gold is now on unstable ground. Yet the pandemic remains, the protest is spreading around the world and the economy is on thin ice.

Markets are potentially subject to another major collapse and with a high-risk event like the crucial US election looming on the horizon, things could get dangerous again quickly. Thankfully, platforms like PrimeXBT they offer the best features that help protect traders from worst case scenarios, black swan events and anything that the wild world of finance can throw in their way.

Take advantage of volatility with technical analysis tools and trade changes

We have all heard the saying "no pain, no gain". It rings true for everything from going to the gym to trading. Even the biggest traders who have ever lived on a regular basis have suffered losses. Pain and loss are inevitable in all aspects of life, especially in finance and business. Even the hottest winning streak can quickly turn into a losing streak. But with a proper risk management strategy, a steady hand and an even stronger stomach, losses can be minimized and can turn the fortunes of profits in favor of a trader.

Risk management takes all shapes and forms when it comes to trading. Start with a solid technical and fundamental analysis. Technical analysis is not a perfect science and is constantly evolving. And although biases can certainly cloud judgment, using specific tools and indicators and observing signals and patterns can increase the odds of success.

Technical analysis helps traders find support, resistance, potential chart formations, candlestick patterns or look for signs of trend changes, overbought or oversold conditions and much more. This can help traders find ideal entries, limit withdrawals and prevent stop losses from being eliminated during shakeouts and stop runs.

In the highly volatile cryptocurrency market, or with pandemic level panic still fresh in people's minds, setting stop loss levels and getting accurate rumors are especially important. PrimeXBT provides traders with all the tools they need to get the job done, make a plan and execute according to the strategy.

The platform offers integrated trading tools from TradingView, as well as dozens of indicators and oscillators such as the Relative Strength Index, Parabolic SAR, MACD, Ichimoku and much more. In addition to stop loss protection, PrimeXBT also offers take profit orders which are triggered when targets are met without having to log in again and manually close. Further adding to unmatched accuracy, the trading engine is highly reliable, offering lightning-fast order execution and limited slippage for the best possible entry.

Enhance reward potential with portfolio diversification and leverage

Risk management is not just about keeping the drawbacks of a trade to a minimum. By improving the potential reward, you can further reduce your risk through the risk: reward ratio. New traders are advised to start with a method called the 1% rule, in which never putting more than 1% of your capital on the line, it would take 100 consecutive losing trades to cancel your account.

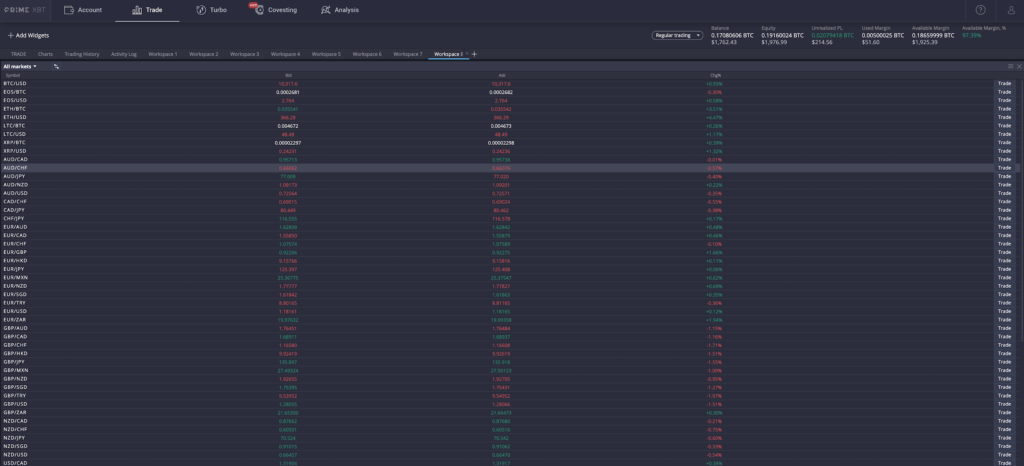

But with PrimeXBT CFDs on cryptocurrency, Traders Union: Best Low Spread Forex Brokers, stock indices e raw material, leverage can steer positions to trade at a much larger size than capital would normally allow. By amplifying the potential earnings, the risk / reward ratio is significantly improved and there are more overall opportunities to close in profit.

Another way PrimeXBT traders can limit their overall risk is to diversify their trading portfolio with various anti-correlated and unrelated assets. Few trading platforms offer traders exposure to gold, oil, Bitcoin, forex, S&P 500, and an equally extensive list of the hottest assets on the market today, all under one roof.

The one-stop shop also allows traders to create hedging positions on any trading tool offered on the platform to take advantage of any market, however it takes place, at any time, even from a free mobile app for Android and iPhone.

Safety, protection and innovative solutions minimize losses

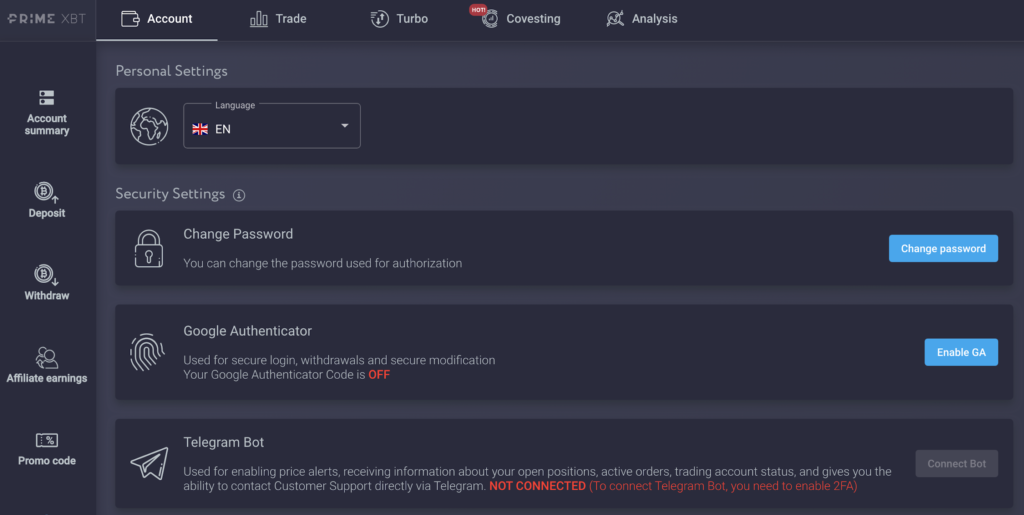

PrimeXBT also keeps the overall risk lower for any trader or investor thanks to its outstanding reputation for safety and security. Different levels of security features such as two-factor authentication and mandatory whitelisting of addresses prevent unauthorized access to the account, and the banking-level infrastructure has protected the platform from any hacks or intrusion attempts.

Another unorthodox way the platform reduces overall risk, especially for new traders who are learning the basics, is through the newly launched Covesting copy trading platform. For those who don't have the time to devote to technical analysis and market research, or those who can't understand proper risk management, they can instead follow skilled strategy managers and earn a worry-free passive income.

A five-star rating system keeps traders honest and transparent so that all followers can make smart and informed decisions about where to place their stake. Risk and ROI metrics make it clear which traders deserve to be followed, but even then, followers are provided with risk management tools to manage any potential drops.

As previously mentioned, even the best traders with hot winning streaks can suffer a series of unexpected losses, especially with markets as unpredictable as they were in 2020.

PrimeXBT - World-class protection against worst-case scenarios that traders face on a regular basis

Traders on other platforms were badly burned on Black Thursday, while users on PrimeXBT were best placed for not just success, but worst-case scenarios that may or may not have occurred.

Ask to any top trader and they'll all tell you the same thing: you can't become profitable without proper risk management. One cannot avoid incurring occasional losses, especially with such high risk and such volatile markets. But because there is always a greater reward, the greater the risk, markets have never been more profitable.

Those who rely on best-in-class trading tools and features will end up achieving class results. Unfortunately, other platforms lacking the overall diversity of tools, instruments and options will leave traders at a loss and not fully prepared for the many worst-case scenarios that markets can throw on a trader's path.