on the crypto

A whirling descent

Privacy without sacrificing scalability is the primary advantage of MimbleWimble, according to the grin developers. The first grin coins were issued through a so-called "fair toss" whereby, like bitcoin, all coins are minted by miners.

"Grin was arguably the most crowded venture capital trade of 2019," said Ryan Gentry, chief analyst at Multicoin Capital. Grin's hash power and mining difficulty began to collapse in August 2019.

After nine consecutive months of decline, the trend shows no sign of reversal. Grin's system-level updates may perhaps be responsible for his declining network activity.

Every six months, the network performs these updates which change Grin's mining algorithm to deter specialized and expensive mining equipment from dominating its hash power.

After the first crossroads, the hashrate and the difficulty of Grin went up, but the second crossroads coincided with the steepest decline of the hashrate in the short history of the currency. Grin is gearing up for yet another drop in the hashrate after the third fork scheduled for July. Grin developers say the cryptocurrency is not designed to satisfy short-term speculative investors.

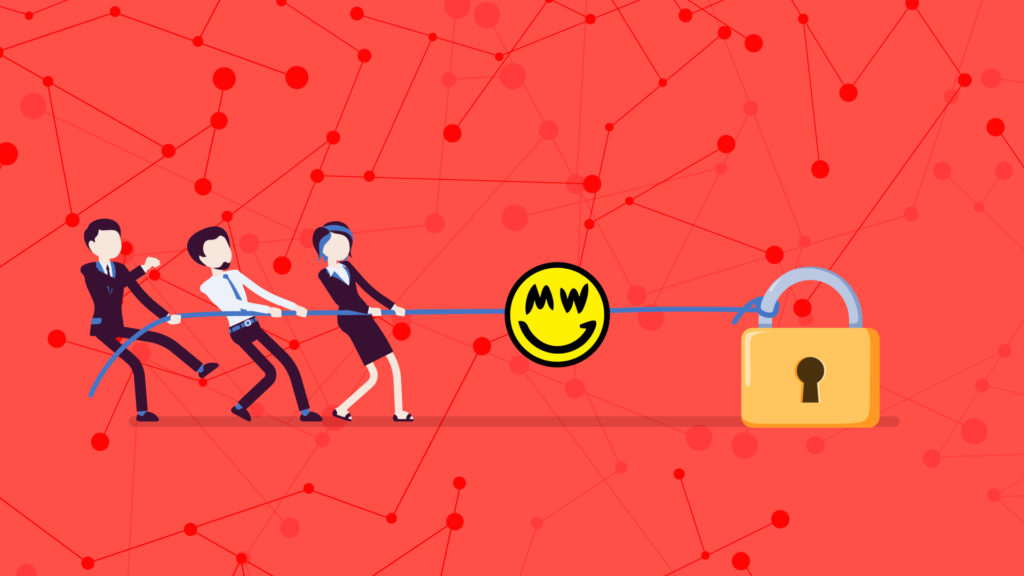

Privacy issues

Adding more trouble to the grin, Dragonfly Capital, based in San Francisco, published research six months ago describing how an "attack" could reveal the identities of 96% of active grin users.

To date, the grin team has not resolved the vulnerability. According to the people who work at grin, the Bogatyy report contains "many logical leaps" and the great use of anonymity is a known and "well documented" problem.

Traders have also lost interest in the grin

Since last June, the price of the currency - quoted in dollars and bitcoins - has only fallen. For example, when it was first launched, the New York City-based cryptocurrency fund Iterative Capital briefly backed the grin on its over-the-counter trading desk and considered participating in the mining.

But it didn't take long for the company to lose interest. Grin was launched during an "altcoin bear market," said grin developer David Burkett. The fact that the price "has so far only moved down" is a "movement very similar to that of many coins thrown at the same time".

Each new cryptocurrency struggles to get adopted initially. But for the cryptocurrency that promised to be a big news, the change of guard between speculators and real users seems to be an uphill battle.