“We know that winter heating bills account for most of the energy needs of low-income households. Therefore, it is imperative that the funds reach families as efficiently and effectively as possible, ”a White House official told the US news agency.

The energy crisis affecting much of the world will also affect US families. According to the National Association of Energy Assistance Directors, each household will have to pay 17% more for heating this winter and bills could reach $ 1.200. Electricity will also increase: in the United States, residential prices are expected to rise by about 7,5%.

More heating and more money printing

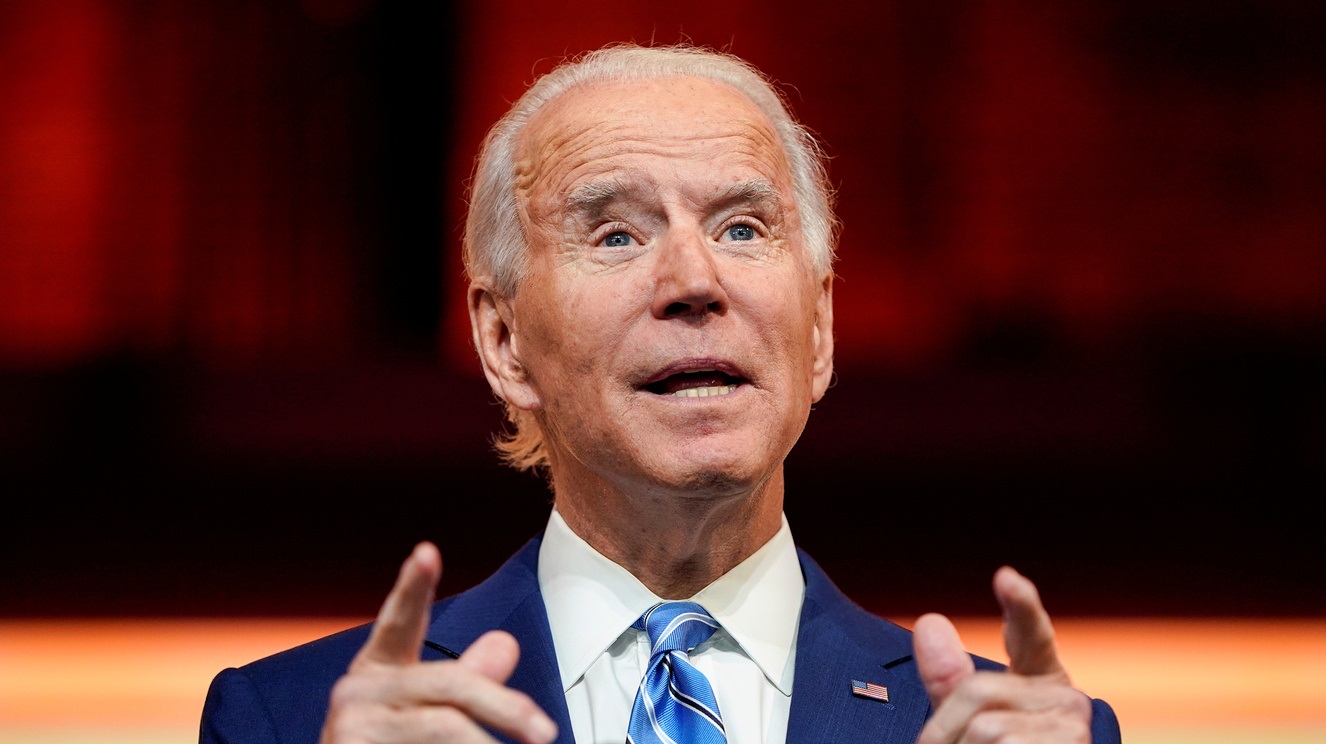

In this context, Biden has decided to grant these benefits, thus seeking to alleviate the effects of winter among the poorest people. But on the other hand there are the consequences of this decision on the US economy, which is currently experiencing the highest inflation in the last 40 years, as we reported some time ago. Inflation was largely a consequence of the inorganic dollar printing that took place during the COVID-19 pandemic.

Thus, the government will again inject liquidity to help a group of people by increasing the money supply, which means that - in the short and medium term - every dollar is worth less in the market. This, as the economic theory known as the Cantillon effect states.

Precisely in an attempt to curb inflation, on November 2 the US Federal Reserve announced a new interest rate hike of 0,75%, beating the North American country's records.

How will markets and crypto react?

When inflation rises, the Investors they are looking for safe haven assets and in recent years, in addition to gold, BTC has come forward. Since it has not been a great year for the digital market, this would lead us to think that next year we will see the recovery of Bitcoin and all the others.