Binance announced the imminent launch of its cryptocurrency loan service. Users can earn up to 15% of interest on BNB.

Binance.com has launched the Binance Lending service and allows users to earn money.

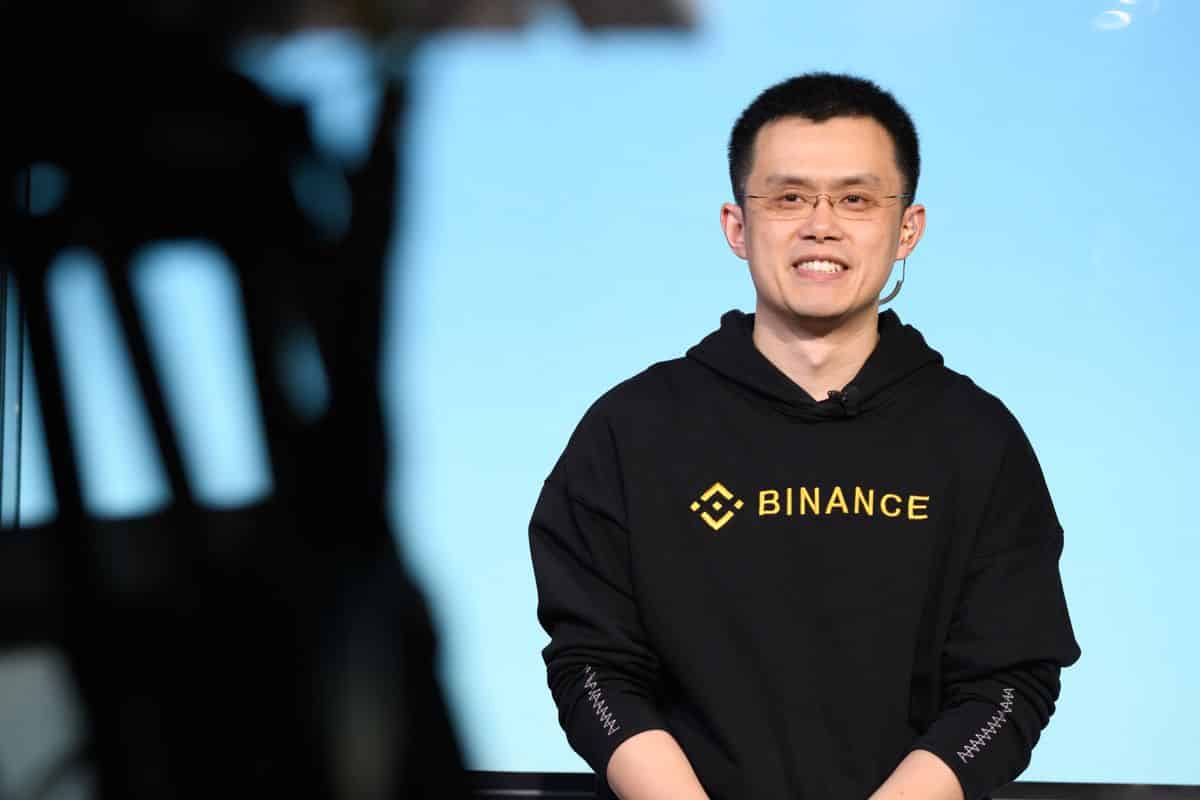

The official route is scheduled for the 28 August 2019, exactly at the 6: 00 UTC. With a tweet, CEO of Binance Changpeng he asked his almost 450 thousand followers if passively buying cryptocurrencies is a great idea.

Binance Lending: the new cryptocurrency loan service

Binance Lending should allow users with cryptocurrencies to lend these digital assets and earn up to 15% of annual interest.

Users will only have access to BNB, USDT ed Ethereum Classic (ETC) of Binance and will earn interest. For BNB, the annual interest rate would be anchored to the 15 per cent, while for the USDT at 10% and for the ETC at the 7%.

There are three different limits for digital assets: the BNB has been set at 500, while the ETC and the USDT have both been set to 1.000 and 1.000.000 respectively. Binance has also set up coverage limits: BNB has been set at a maximum of 200.000, USDT at 10.000.000 and 20.000 ETC.

Last month, Binance announced that it would allow the margin trading on its platform. This new feature will allow the Exchange to compete with its rival Bitmex.

Binance has announced that the assets to be supported include BTC, ETH, XRP, BNB, TRX and USDT. The co-founder of Binance, Yi He, stressed that:

"margin trading is one of the most requested services by the Community and is very promising for the future. "

Shortly before Binance Lending was made official, the Exchange announced its intention to increase the daily interest rates for the ETC from 0,02% to 0,04%.

Binance Loan Service Agreement

The contract published on the site details eight different points concerning the authorization to avoid the risks involved in the cryptocurrency loan.

For example, he states that the authorization and distribution of financially leveraged assets will be treated as prescribed by the Binance rules.

Some points that can delimit the are also mentioned anti-money laundering methods (AML) and fraud prevention.

Binance reserves the right to close its loan platforms whenever it wants, but does not mention whether customers will be informed.

The Binance loan service contract ends with the following statement:

"Due to network delays and computer system failures, which can lead to delays, suspension or deviation of the execution of the Binance Lending service, Binance.com will undertake to ensure continuity of service".