Coinbase is not worried about possible changes in Japanese policy. The American exchange is confident about Japanese business.

Coinbase, one of the most famous exchanges in the world, has declared that it is not at all worried that the Financial Services Agency (FSA) of Japan can see in a more critical and suspicious manner the cryptocurrency industry.

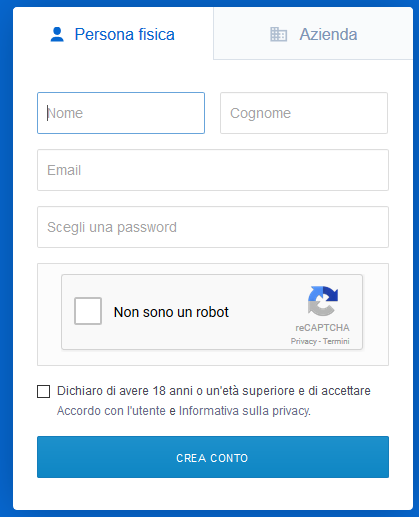

In particular, speaking with Nikkei Asian Review, Mike Lempres, chief policy officer of Coinbase, said that more control over the cryptocurrency exchange requiring virtual currency licenses in Japan is actually a good thing for one's company, because it would give them an edge over the competition. "The Japanese government is more focused on security - he said - and this is good for us". The discussions with the FSA are "going well", he continued, hoping that the 2019 is the right year for the launch of the services.

However, this is a courageous statement, some analysts stress, especially considering that, as a note Nikkei, the FSA has not approved a virtual currency license since December 2017, just before the exchange Coincheck, of Tokyo, was breached for an 530 million dollar record in January 2018. Last month, the Osaka-based trading platform Zaif lost 60 million dollars following a hacker attack, and now it is struggling to compensate customers for how much lost.

Coinbase believes these hacker attacks, rather than making regulators and hesitant investors commit to the burgeoning encrypted currency industry, will increase the demand for companies with a reliable track record. "The Japan it has been an active market since the beginning, and it has proved to be resistant, since it has recovered from several negative experiences, "said Lempres -" We think there is a great demand here for a reliable service provider".

Lempres then explained that Coinbase devotes much more resources to the security of customer assets than many other cryptocurrency exchanges, with "dozens" of 550 studio employees working full-time on security.

Lempres also explained that only one percent of the company's funds are kept in "hot wallets" online, while the remaining 99 percent is protected in cold wallets, not connected online. Furthermore, that 1% of funds held in Coinbase hot wallets are fully insured.

However, although it is a global company with operations in dozens of countries, the Coinbase security apparatus is centered in the United States, which could lead to problems if the FSA continues to claim that it wants Coinbase Japan to physically preserve its assets in Japan, where the agency can monitor them more easily.

Last week, it emerged that Tiger Global, a major speculative fund in the United Kingdom, was about to complete an investment of 500 million dollars in Coinbase. Several reports differed on whether the fund was buying shares directly from Coinbase or on the secondary market, but on one aspect they all agreed: the investment would have valued Coinbase 8 billions of dollars, consolidating its status not only as one of the most large cryptocurrency companies but also as one of the most important private technology companies in the world.