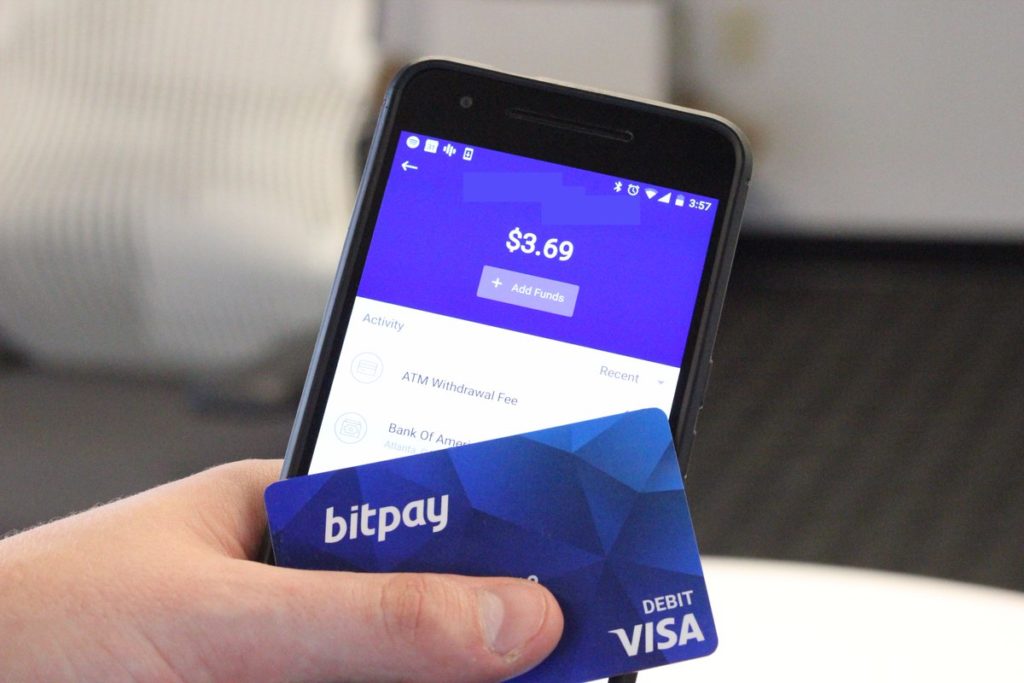

BitPay thinks big and aims to become a national bank

According to a December 8 official notice published by the Atlanta Journal-Constitution, BitPay has turned to the Office of the Comptroller of the Currency (OCC) to become a federally regulated bank, called BitPay National Trust Bank, based in Georgia.

The news was first reported by The Block. The filed document requires a 30-day waiting period, in which comments will be made to address to the OCC Licensing Director.

Brian Brooks announced earlier this year that he would seek to establish a licensing framework for fintech startups, including cryptocurrency companies, to streamline their operations in the United States.

At the moment, cryptocurrency exchanges and other digital payment companies must acquire the appropriate licenses for the role they intend to fill in each of the U.S. states and territories they hope to operate in, as it did for example. Bitcoin Pro.

According to BitPay's question, the total capitalization that its national bank would receive for the shares issued would be around $ 12 million, with 120 million shares to be issued. By becoming a national bank, companies like BitPay could circumvent the current state-by-state legal regime.

The backlash from US banks and Democratic lawmakers

The controller said in September that his agency would be ready to start processing applications. More recently, he told CNBC that the crypto space could receive good news at the end of the year.

However, his words have sparked a backlash from banks and Democratic lawmakers who see his focus on cryptocurrencies as excessive and deregulated. Last week, U.S. Dem Representative Maxine Waters, who chairs the House Financial Services Committee, wrote a letter to incoming President Joe Biden asking him to reverse a number of actions conducted by his predecessor's agency heads, including all Brooks' crypto provisions.

It is unclear whether Biden will comply with the request. Brooks could also take on a full five-year term at the OCC. Last month, President Donald Trump named the former Coinbase general counsel for the role, but the Senate has not yet announced a confirmation vote.

If Brooks is not confirmed, Biden or her designated Treasury Secretary, Janet Yellen, can establish another name. Recently, the STABLE Act was introduced in the United States, which would require all stablecoin issuers to follow banking regulations.

BitPay confirmed the move in an e-mailed statement. "Our operations as a national trust bank will be subject to stringent security and soundness requirements, which will provide our clients with assurance that our services remain best-in-class and allow us to be subject to a uniform regulatory framework," the statement said.